Makaleler

26

Tümü (26)

SCI-E, SSCI, AHCI (2)

SCI-E, SSCI, AHCI, ESCI (6)

ESCI (4)

Scopus (5)

TRDizin (12)

Diğer Yayınlar (10)

2. An Analysis of Some Selected Economic and Social Factors Affecting Wine Sector: A Fuzzy Clustering Analysis1

Hacettepe Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi

, cilt.41, sa.Tarım Özel Sayısı, ss.111-123, 2023 (TRDizin)

6. Türk Vergi Ceza Hukukunda Ne Bis in İdem İlkesi:Avrupa İnsan Hakları Mahkemesi’xxnin Verdiği Kararlardan Lucky Dev Davası

Hacettepe Hukuk Fakültesi Dergisi

, cilt.7, sa.2, ss.95-104, 2018 (TRDizin)

7. İnsan Hakları Avrupa Mahkemesi’nin Kararlarından Pakozdi Davası:İdari Vergi Ceza Davalarında Duruşmasız Yargılama

Hacettepe Hukuk Fakültesi Dergisi

, cilt.7, sa.2, ss.83-94, 2018 (TRDizin)

8. Entrepreneurship and Tax Policy:An Analysis of Marmara and the Black Sea Region in Turkey

International Journal of Economic Perspectives

, cilt.11, sa.2, 2017 (Hakemli Dergi)

9. Tax Policies and Entrepreneurship:The Case of Turkey

International Journal of Economic Perspectives

, cilt.11, sa.1, ss.453-463, 2017 (Hakemli Dergi)

15. TÜRKİYEDE YEREL YÖNETİMLERDE REFORM ÇALIŞMALARI

E-YAKLAŞIM

, sa.0, 2011 (Hakemli Dergi)

16. EFFECTS OF THE EUROPEAN CONVENTION ON HUMAN RIGHTS ON THE TURKISH TAXATION POLICY AND MANAGEMENT

ACCOUNTANCY BUSİNESS AND THE PUBLIC INTEREST

, sa.2011, ss.124-131, 2011 (Hakemli Dergi)

17. POS CİHAZLARININ SATIŞ DIŞI AMAÇLARLA KULLANILMASININ VERGİSEL BOYUTU

E-YAKLAŞIM

, sa.206, 2010 (Hakemli Dergi)

18. Uluslar Arası Alanda Faizlerin Vergilendirilmesi ve Özellikli Bazı Durumlar

Mualla Öcele Armağan

, sa.243, 2009 (Hakemli Dergi)

21. Uluslararası Performans Gösteren Sanatçı ve Sporcularda Aşırı Vergi Yükü Sorunu

VERGİ SORUNLARI DERGİSİ

, cilt.29, sa.218, ss.186-193, 2006 (TRDizin)

22. VERGİLENDİRMENİN GİZLİ MALİYETLERİ ÜZERİNE

MALİ PUSULA AYLIK TİCARİ VE MALİ İŞLEMLER DERGİSİ

, sa.21, ss.131-143, 2006 (Hakemli Dergi)

23. VAKIFLARIN DEVLET TARAFINDAN FİNANSE EDİLMELERİNİN ETKİLERİ VE BUNUNLA İLGİLİ TARTIŞMALAR

YAKLAŞIM

, cilt.14, sa.164, ss.245-225, 2006 (Hakemli Dergi)

24. MALİYE POLİTİKASININ MAKRO EKONOMİK BOYUTLARI

İKTİSAT İŞLETME VE FİNANS

, sa.163, ss.55, 1999 (Hakemli Dergi)

25. VERGİDE YATAY EŞİTLİK İLKESİNİN ELEŞTİRİSİ

VERGİ DÜNYASI

, sa.202, ss.100-103, 1998 (TRDizin)

26. ARTAN ORANLI GELİR VERGİSİNİN TEORİK TEMELLERİNE ELEŞTİRİLER

YAKLAŞIM

, sa.55, ss.107, 1997 (Hakemli Dergi)

Hakemli Bilimsel Toplantılarda Yayımlanmış Bildiriler

7

1. TAX EXPENDİTURE ASPECT OF UNIVERSITY EDUCATION:THE MODEL OF TURKEY

11th Annual Conference of the EuroMed Academy of Business, Valletta, Malta, 12 - 14 Eylül 2018, ss.1302-1310, (Tam Metin Bildiri)

3. Tax policies and Entrepreneurship:The Case of Turkey

6th.International Conference on New Challenges in Management and Business, 11 Şubat 2017, (Tam Metin Bildiri)

4. Entrepreneurship and Tax Policy:An Analysis of Marmara and the Black Sea Region in Turkey

6th International Conference on New Challenges in Management and Business, 11 Şubat 2017, (Tam Metin Bildiri)

7. Taxation of interest rate swap transactions in Turkey

International Conference on Banking and Financial Perspectives (ICBPF), 13 - 15 Nisan 2011, (Tam Metin Bildiri)

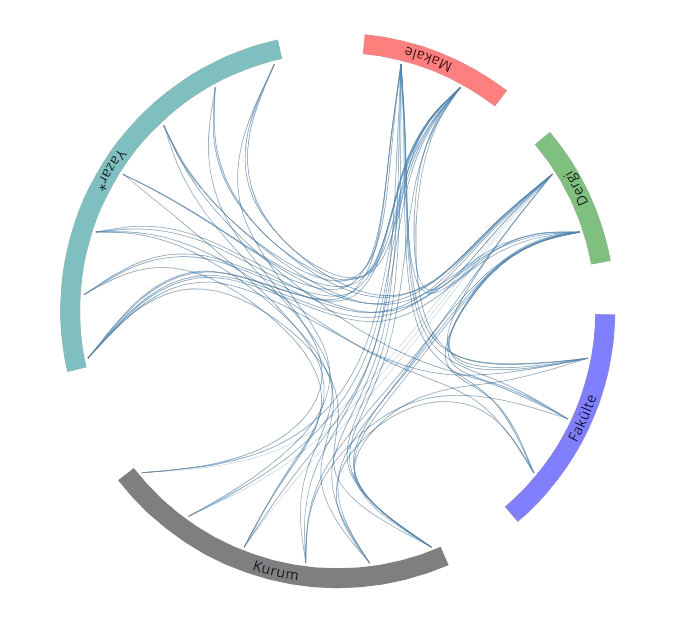

Yayın Ağı

Yayın Ağı